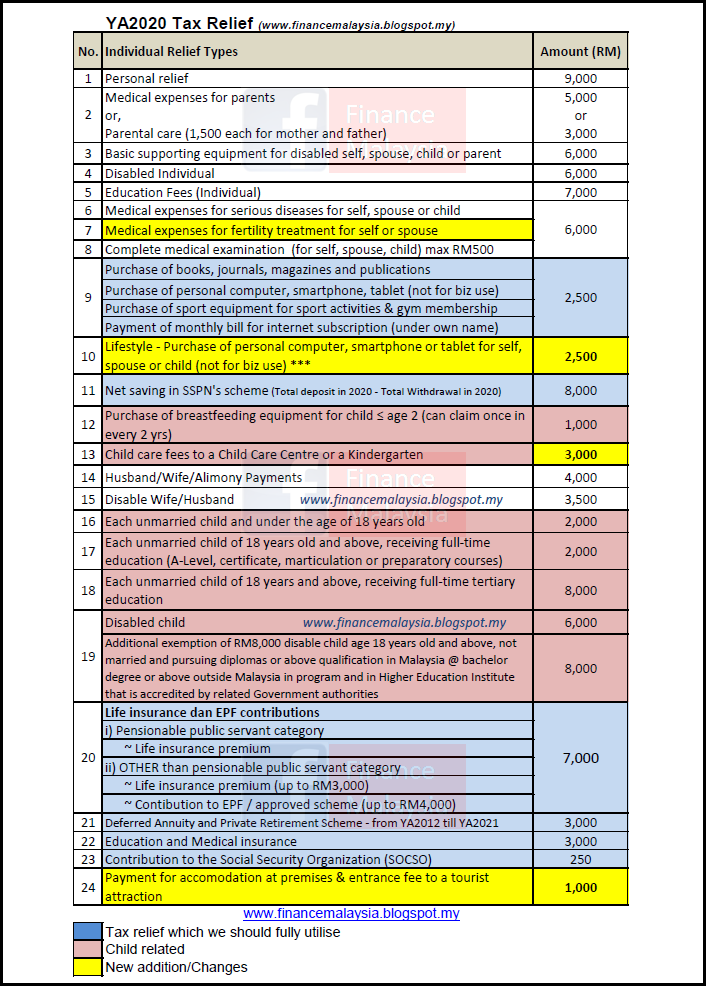

Lifestyle tax relief 2021 malaysia - These Are The Personal Tax Reliefs You Can Claim In Malaysia

Tax relief Malaysia: LHDN's full list of things to claim in 2022 for YA 2021

Budget 2021: Tax relief on medical treatment raised, including for parents

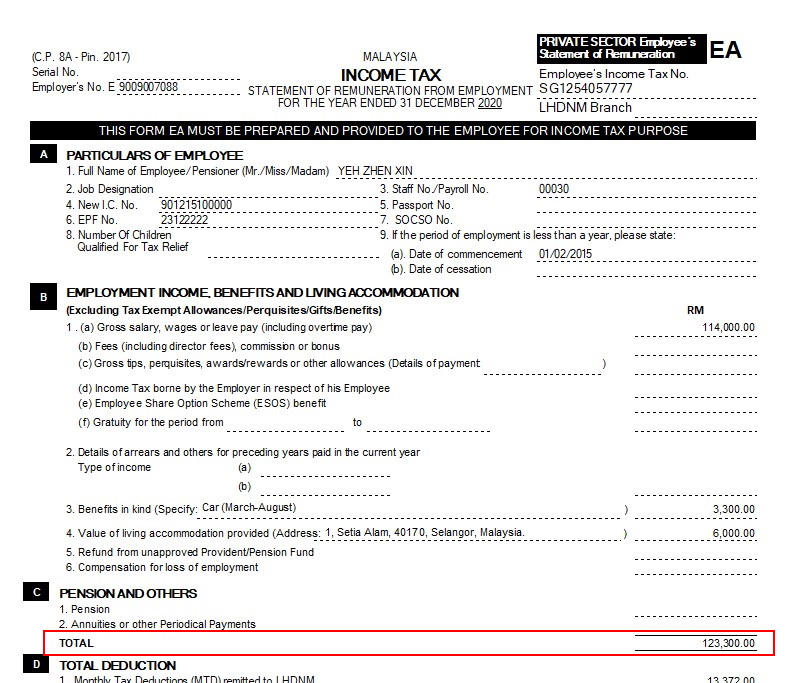

Malaysia

Malaysia: Tax Highlights of Malaysia's Budget 2021

Malaysia Income Tax 2022: A guide to the tax reliefs you can claim for YA 2021

Public Ruling No. 5/2021

Budget 2021: Tax relief on medical treatment raised, including for parents

Personal Tax Rates 2021

Visit our to learn more.

Comments: Presently, the Principal Hub incentive offers preferential tax rates of 0%, 5% and 10% on the trading and services income of qualifying companies for 5 years, with varying conditions.

The next question is, do you know what type of tax reliefs that you can claim? Fees paid to childcare centres and kindergartens RM3,000 RM3,000 18.

What Are The Tax Reliefs (YA 2021) in Malaysia

In brief On 6 November 2020, the Malaysian Minister of Finance unveiled the Malaysian Budget 2021 " Budget".

For Medical treatment for serious diseases or illness the tax relief 2021 limit will increases from RM 6,000 to RM 8,000 for individual taxpayer, spouse and children whereby for a full health screening, the tax relief will increase from RM 500 to RM 1,000.

If you have any dependents on you such as parents or children, they will be included in this as well.

- Related articles

2022 blog.mizukinana.jp

.jpg)

.jpg)